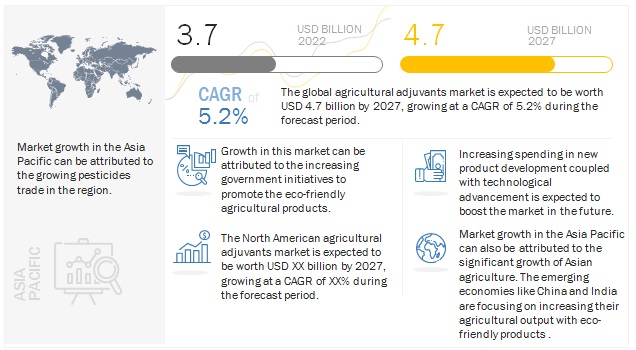

The Agricultural Adjuvants Market size is estimated to be valued at USD 3.7 Billion in 2022 and is projected to reach USD 4.7 Billion by 2027, recording a CAGR of 5.2% during the forecast period in terms of value. The market is driven by the various developments in farming techniques and increasing investments in agrochemicals for higher yields. The growing demand for crop protection products has also resulted in the development and commercialization of sustainable crop protection solutions that comply with environmental regulations. These market trends are anticipated to boost the sales of agricultural adjuvants over the foreseeable future.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1240

Activator adjuvants was the largest function segment in the global agricultural adjuvants market and is expected to maintain the dominance over the forecast period

Due to their high compatibility with various pesticide formulations, activator adjuvants are the most widely consumed agricultural adjuvants. Most herbicides are mixed with surfactants to improve their spraying characteristics. Some of the activity modes of activator adjuvants include reducing the surface tension of the spray solution to enhance the contact area, increasing spray retention, and maintaining the stability of the herbicide in the spray solution.

Tank-mix is anticipated to be the fastest-growing adoption stage segment in the agricultural adjuvants over the forecast period

Tank-mix adjuvants ensure activation and compatibility for challenging formulations. The main class of tank-mix adjuvants has spray formation and retention properties that ensure improved pesticide usage efficiency. As a result, the demand for these ingredients is growing more in sustainable farming practices to enable reduced pesticide use, lower treatment costs, and ensure a better yield.

Herbicides was the largest application segment in the agricultural adjuvants market

The increasing demand to reduce pesticide redundancy, environmental concerns, and the introduction of adjuvants for herbicides with multifunctional properties are factors that are projected to increase the demand for such adjuvants during the forecast period.

Suspension concentrates was the largest formulation segment for the agricultural adjuvants market and anticipated to maintain the dominance over the forecast period.

Suspension concentrates are solid active ingredients that can be dispersed in water. The active ingredients that are solid at room temperature could either be formulated as water-based suspension concentrates or can also be combined with co-formulants to be utilized as water-dispersible granules or wettable powders, which would disperse readily in a spray tank. Unlike emulsifiable concentrates and wettable powder formulations, suspension concentrates are gaining popularity as they offer various benefits, such as the absence of dust and flammable liquids, the small particle size of active ingredients, ease of use, and effectiveness.

Cereals & grains is anticipated to be the second fastest growing crop segment in the agricultural adjuvants market.

This is attributed to the increasing consumption of crop protection chemicals for cereal and grain crops, particularly in the Asian and North American regions. Also, due to the increasing demand for crops such as corn, wheat, rice, and sorghum across various industries, the consumption of crop protection chemicals is projected to increase.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=1240

North America was the largest region for the agricultural adjuvants market in 2022.

North America is the leading consumer of pesticides due to the high regulatory compliance requirements for pesticide application. As the adoption rate of agricultural adjuvants in these countries remains high, North America dominated the market in 2021. This market is also projected to witness a steady demand during the forecast period.

Since the number of bans on the usage of chemical pesticides in European countries is increasing, the market for agricultural adjuvants is projected to grow at a sluggish rate in this region compared to other regions. On the other hand, with increasing investments in the expansion of production facilities in the Asia Pacific, the market in this region is projected to witness exponential growth during the forecast period.

Key Players:

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as Corteva Agriscience (US), Evonik Industries (Germany), Croda International (UK), Nufarm (Australia), Solvay (Belgium), BASF SE (Germany), Huntsman Corporation (US), Clariant AG (Switzerland), Helena Agri-Enterprises LLC (US), Stepan Company (US), Adjuvant Plus Inc. (Canada), Wilbur-Ellis Company (US), Brandt, INC. (US), Plant Health Technologies (US), Innvictis Crop Care LLC (US), Miller Chemical And Fertilizer, LLC (US), Precision Laboratories, LLC (US), CHS Inc. (US), Winfield United (US), KaloInc. (US), Nouryon (Netherlands), Interagro Ltd. (UK), Lamberti S.P.A (Italy), Garrco Products, Inc. (US), Drexel Chemical Company (US), and Loveland Products Inc. (US).

Comments

0 comments