See our latest analysis for Herbalife Nutrition

Within the above chart now we have measured Herbalife Vitamin’s prior ROCE towards its prior efficiency, however the future is arguably extra vital. For those who’re , you’ll be able to view the analysts predictions in our free report on analyst forecasts for the company.

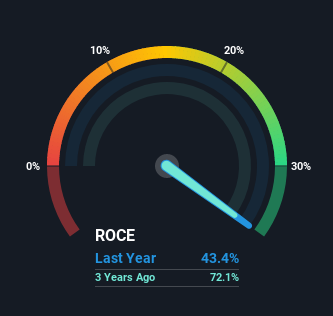

So How Is Herbalife Vitamin’s ROCE Trending?

When it comes to Herbalife Vitamin’s historical past of ROCE, it is fairly spectacular. The corporate has persistently earned 43% for the final 5 years, and the capital employed inside the enterprise has risen 62% in that point. Returns like this are the envy of most companies and given it has repeatedly reinvested at these charges, that is even higher. You may see this when taking a look at properly operated companies or favorable enterprise fashions.

Comments

0 comments